*The minimum balance required to open this account is $2,500.00. We also offer basic Primary Savings Accounts. Additional balance tiers up to $100,000 and above earn even higher dividends, so you can make the most of your money.

Offering a higher yield than our traditional savings account, a money market account requires a balance of at least $2,500 to open and obtain dividends. Since money market funds are available for withdrawal without penalties, this type of account is a great option for your emergency fund savings.Įarn a higher dividend rate with a Bellwether money market account. When you're ready to use your funds, access by way of check, debit card, or online transfer. Provide your information, make an initial deposit, and sit back - your money will begin earning interest at a variable. Make your money work harder for you by taking advantage of the higher dividends and easy access of a money market account.Ī money market account works in the same manner as other types of savings accounts. This type of account typically earns better dividends than your average savings or checking account. MyMoney MyGoals combined with our existing refund commission solution provides the tools to assist learning and education for the self-directed consumer.If your traditional savings or checking account holds a high balance, consider moving your funds to a money market account with Bellwether Community Credit Union.

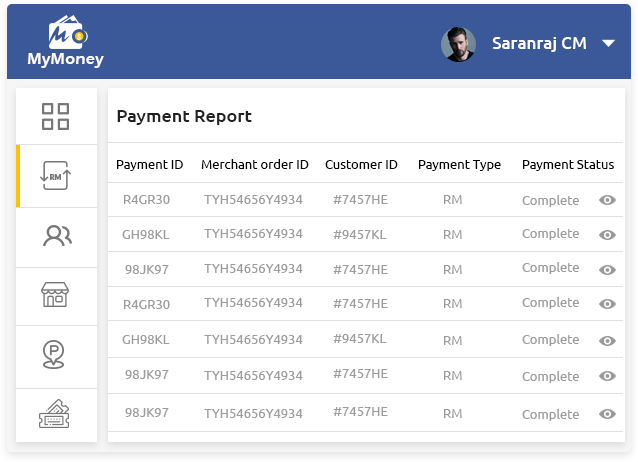

MYMONEY ONE ACCOUNT FULL

MyMoney MyGoals can provide consumers with simple and easy access for a ll your accounts in one place for a full view of your money, r eceive timely updates on each of your connected accounts, g et a snapshot of all your active goals to stay on top of your money, v iew spending across all your accounts to see exactly where your money is going, g et real-time insights that help you spend less and save more.įinance can be a confusing, even intimidating subject for many consumers, and a lack of knowledge can see them missing out on savings or solutions that would benefit them. As more consumers continue to use digital channels, they're expecting institutions to offer personalized user experiences that helps them reach their financial goals," said Graham Chee, Founder and Managing Director "By using the MyMoney MyGoals Intelligence Platform, our goal is to empower consumers to create personalized and actionable insights and recommendations for consumers." "Relationship-based financial technology has been the key to success and customer loyalty for financial institutions for years. The insights we gain from liaising with our AI ChatBot will allow us to train Melanie in the type of questions that are commonly asked. Although in the early stages of development the AI ChatBot will rapidly learn to utilise the natural language program and ease of use tools.

Utilising our AI Chat Bot named Melanie, consumers can use the instant messaging apps of Messenger, Skype, Telegram, Viber, Line, Kik or Web chat to communicate and ask questions. MyMoney MyGoals provides visual data and notifications such as progress bars, charts, graphs and alerts, engaging customers with the option to flex and prioritise goals.

The application allows customers to better track their goals by allowing consumers to allocate multiple goals to a single account, or spread a single goal across multiple cash and investment accounts. The MyMoney MyGoals application allows consumers to easily set and track savings goals. The service is designed to increase Australian consumers’ financial literacy while encouraging the use of MyMoney’s platform as a financial services marketplace. Australian financial services and technology development solutions provider MyMoney today announced the launch of Money® MyGoals®.

0 kommentar(er)

0 kommentar(er)